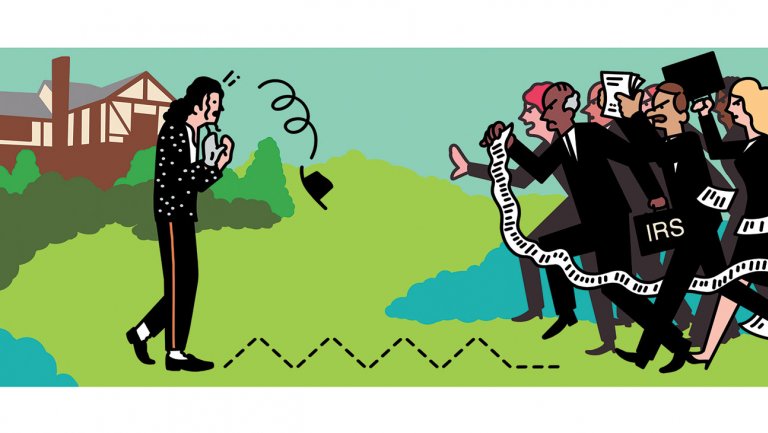

How much was the King of Pop’s name and image worth when he died? The estate says $2,105, but the IRS insists its value is more than $434 million. “It seems preposterous that the IRS would arrive at a value 10 times [what Jackson earned licensing his name while he was alive],” says the estate’s lead attorney, Howard Weitzman. “This is bizarre.”

Of all the befuddling legal matters in the entertainment business, there’s perhaps none that causes attorneys to scratch their heads like the battle between Michael Jackson and the Internal Revenue Service over what the late entertainer should be paying in estate taxes. In the years after his death in 2009 at age 50, Jackson has experienced a commercial rebirth thanks to the savvy executors who have managed his assets. The 2009 documentary This Is It grossed $261 million, a Cirque du Soleil tribute show packs in fans, and there have been albums, video games and other lucrative memorials. Now the IRS wants its share, claiming the value of Jackson’s name and image upon death amounted to more than $434 million. The estate’s own valuation? Just $2,105.

That’s a huge discrepancy, and even that difference undersells the stakes. With interest and penalties, lawyers estimate the case — set for trial at a Los Angeles tax tribunal in 2017 — could be worth more than $1 billion. Some tax specialists even wonder if it could lead to criminal tax evasion charges. The outcome could impact celebrity estate planning. “This is the biggest estate tax case I’ve ever seen,” says attorney and tax specialist Gary Wolfe.

Given that, it might be surprising to learn the Jackson reps have little idea about what to expect in the case. Speaking publicly about the IRS battle for the first time, Howard Weitzman, the estate’s lead attorney, says both sides haven’t exchanged much information and the IRS hasn’t explained how its independent auditor determined the huge valuation. Executors John Branca and John McClain have overseen a remarkable turnaround, wiping out Jackson’s debt and making enough revenue to generate about $100 million in tax payments already. But Weitzman estimates that Jackson earned no more than $50 million from the licensing of his name and image when the pop star was alive, even during Jackson’s Thriller heyday. “It seems preposterous that the IRS would arrive at a value 10 times this amount,” he says. “This is bizarre.”

And importantly, what matters most for tax purposes is the value of Jackson’s name and likeness at the time of his death — not now, after his executors have worked their magic. “Michael Jackson had no merchandising deals then,” says Weitzman. “Only after we began the resurrection and This Is It did things begin to change. The IRS says, ‘You should have known about the documentary.’ That’s like [saying] we should have known he was going to die.”

And why didn’t the King of Pop earn licensing money in the years before his death? See: charges of child molestation, rumors of drug use and no tours back then. In fact, when he died of an overdose, he was preparing for a “comeback” tour. It’s enough to take a wonky tax case into sensational territory.

The IRS declined to comment, but one source in Hollywood’s legal community says the agency has asked for some of the documents in the Jackson family’s wrongful death case against AEG, the concert promoter that was set to stage the Jackson tour before he died. (AEG won the case against Jackson’s estate, and the family lost its attempt to appeal.)

Wolfe speculates the IRS could be interested in rebutting the estate’s position that Jackson’s likeness held no value at the time of his death by showing interest from AEG and others. “Who were the corporate sponsors?” asks Wolfe. “This is a total clusterf— that makes zero sense. You’re telling me that Jackson’s name was worth less than a bottle of expensive wine?”

Adam Streisand, a probate attorney who has worked with celebrity estates including those of Ray Charles, Marlon Brando and Marilyn Monroe, says he doesn’t expect the IRS to be able to point to other celebrities’ post-death earnings as part of the valuation process. Instead, a judge’s valuation could focus on what licensors were willing to pay to be associated with Jackson rather than what he actually got in sponsorship and merchandise deals. Weitzman thinks this is a “once in a lifetime” case, but others aren’t sure. If the IRS wins, it likely will pursue other celebrity estates that have increased in value. The business of commercializing dead stars has boomed in recent years as publicity rights have expanded and technology such as holograms and CGI has allowed the dead to live on in entertainment. For that reason, those with the ability to profit from their fame should start preparing — or they will sock their heirs with a huge tax bill.

Streisand helped write the California law that gives celebrities posthumous rights to their names and images. It’s been a boon to the spouses and children of these famous people, but there have been ramifications, the Jackson case serving as perhaps the most high-profile example. Asked if he’s partly responsible for the IRS’ hunt, Streisand responds: “I plead guilty as charged. It’s the statute that really codifies the concept that a celebrity’s name and image is a property right like a house — and it’s hard for me to say it doesn’t have value.”

SOURCE: Hollywood Reporter

Why can’t they let Michael RIP. People were always out for what $$$$$$$ they could get out of him when he was alive and they are still carrying on after he’s gone. Everyone wants a piece of Michael Jackson. The IRS better not win, I don’t see how they can. Pure greed. Love you Michael, LOVE LIVES FOREVER